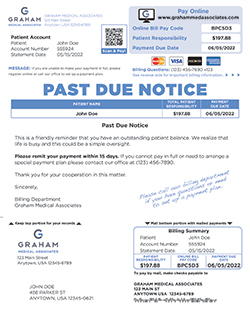

You can also include the address of the place where a check or money order can be sent. Include an online payment link so that they can enter their bank or card details. Provide a call to action and explain how the client can make the payment. Make these details stand out by using formatting such as bolding and spacing. Be sure that you have the correct amount in the client’s account and all past communications. Provide the client with the invoice due date and the amount owed. Here are a few examples of subject lines for emails with past-due invoices: Mention the company name and add the invoice number of the order to give the email some context. This grabs the attention of the client and instantly reminds them that a payment is due. Include the invoice number in the subject line.Ĭreate a subject line that references the invoice. To effectively compose a past-due invoice email and decrease bad debts, consider the following steps: Regardless of whether it is an individual, a business, or both, legal action for non-payment of invoices can be issued with a formal demand letter to the non-paying client. It can incentivize customers to pay on time. Offer a longer deadline or allow customers to pay in installments if necessary.Ī penalty can be imposed if a customer delays payment beyond the due date. It works well when customers forget to pay their invoices, which is quite often the case.Ĭonsider calling the client if they do not respond to your payment reminders and provide a solution to their payment issues. You can send gentle payment reminders when invoices become overdue. Here, we’ll talk briefly about some of the effective approaches to collecting past-due invoices. Companies not only have to ensure they are paid on time but also see to it that customers do not feel badgered when they are sent dunning emails. State: Payment Plan for Arrearages (MCL 552.To avoid ruining customer relationships, businesses must tread carefully when managing unpaid and past-due invoices. Yes, you still have to pay your current support along with any Arrears Payment Plan amount. An attorney can file the payment plan motion but you can also file a motion yourself using the motion with the circuit court for a payment plan form (the link provides the form and instructions). If the plan is approved, and, if during the payment plan, your circumstances change, the payment plan may be modified or terminated. However, depending upon the circumstances of your case, your payment plan may or may not be approved by the court. You must file a motion with the circuit court for a payment plan (the link provides the form and instructions). The court will consider the state's comments. OCS Central Operations - Arrears Payment Plan Review Unit You may request an Arrears Payment Plan if the support arrearage is owed to the state however, the Michigan Department of Human Services' Office of Child Support will comment in support or opposition to your plan and must receive a copy of the court motion requesting an arrears payment plan at least 56 days (8 weeks) before the court hearing date on the motion.

If your arrearage is owed to an individual, yes, that individual must agree to the plan. If approved, the court determines how much of the arrearage is eliminated after the Arrears Payment Plan is completed.ĭoes the person to whom I owe arrears have to agree to the Arrears Payment Plan? You must ask (petition) the court of an Arrears Payment Plan. Yes, Michigan law allows you to ask (petition) the court for an Arrears Payment Plan if you can show that you cannot afford to pay your past due support (arrears). What if I have an Arrears Payment Plan and my circumstances change?ĭo I have to have an attorney to request an Arrears Payment Plan?ĭo I still have to pay my current support if I have an Arrears Payment Plan? How do I request an Arrears Payment Plan? What if my support arrears is owed to the state, how do I notify the state? If I cannot afford to pay my past due support (arrears), can I ask the court to reduce the amount of arrears owed?ĭoes the person to whom I owe arrears have to agree to the Arrears Payment Plan?

0 kommentar(er)

0 kommentar(er)